LIHTC, HOME Funds, & HUD Loans Explained - How to Structure 100s of Deals! - Tim Van Rooy

How LIHTC, HOME Funds, and HUD Loans Shape Affordable Housing Deals

Why This Episode Matters

Affordable housing projects don’t just come together with goodwill, they require complex financing structures. In this episode of the Affordable Housing & Real Estate Investing Podcast, Kent Fai He sits down with Tim Van Rooy, a seasoned affordable housing consultant with deep experience in HUD loans, Low Income Housing Tax Credits (LIHTC), and HOME funds.

Tim has underwritten hundreds of HUD loans, managed city-level HOME grants, and worked directly with nonprofits and housing authorities to get deals across the finish line. If you’ve ever wondered how affordable housing is actually funded—or why some projects succeed where others fail—this conversation gives you the frameworks, numbers, and strategies that developers and advocates need to know.

What are HUD loans and why do they matter in affordable housing?

HUD loans provide some of the most favorable financing terms available in real estate. Tim explains that HUD’s loan programs offer:

Low interest rates compared to conventional lending.

High leverage, sometimes up to 90 percent loan-to-cost.

Long amortization periods, often stretching 35–40 years.

However, HUD loans also come with challenges. Approval timelines can stretch 6–12 months, and holidays or government slowdowns can bring progress to a halt. Tim emphasizes the importance of relationships: knowing your local HUD office and maintaining consistent communication can shave months off a deal’s timeline

.

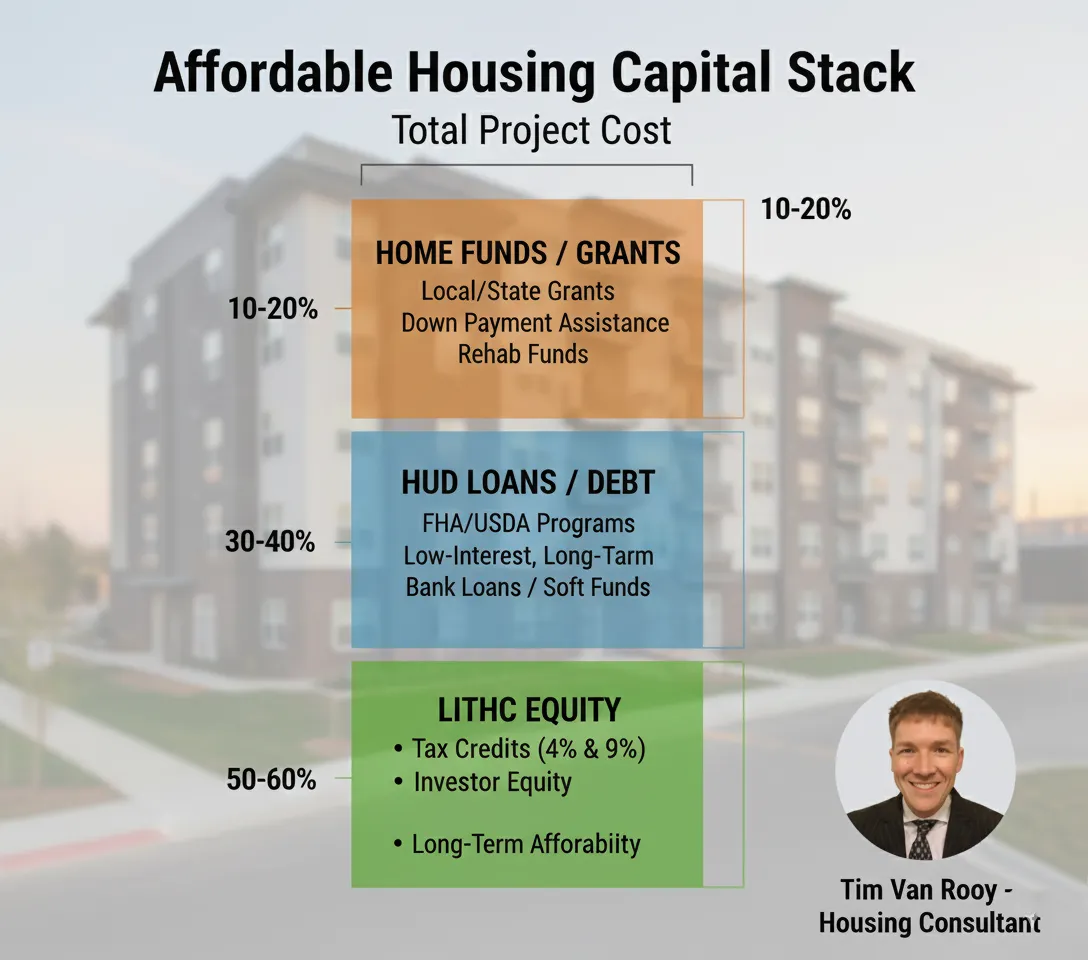

How do 4% and 9% LIHTC deals compare in the capital stack?

One of the most common questions investors and developers ask: what percentage of project costs can LIHTC actually cover? Tim breaks it down:

4% deals: Roughly 40 percent LIHTC equity, 40 percent debt, and 10 percent developer fee

.9% deals: Closer to 60 percent LIHTC equity, 30 percent debt, and 10 percent fee.

While 9% credits are more lucrative, they’re also more competitive and awarded in limited rounds. Tim notes that both structures almost always require multiple funding sources—such as bank loans and soft funds from local governments—to “pencil” properly.

How do you calculate LIHTC tax credits?

Tim offers a simple back-of-the-envelope calculation:

Start with eligible basis (eligible construction costs).

Multiply by the percentage of affordable units.

Example: $2.5M basis × 75% affordable = $1.875M qualified basis.

Multiply qualified basis by tax credit percentage (4% or 9%).

The result = annual tax credits, which can then be sold to investors or syndicators for equity

.

Market dynamics also play a role—credits may trade at $0.80–$0.90 on the dollar depending on investor appetite.

What are HOME funds and how do they support housing?

Unlike LIHTC, which primarily funds large-scale projects, HOME funds can support smaller deals and even first-time homebuyers. Tim explains that HOME funds can be used for:

Rental housing development or rehab.

Down payment assistance programs.

Grants or low-interest loans for nonprofits and cities.

Each state and city (known as “participating jurisdictions”) sets its own rules for allocating HOME funds, typically outlined in their applications. Project readiness, environmental friendliness, and equity considerations often determine which projects win awards

.

Key Insights from Tim Van Rooy

Every deal requires multiple funding layers: LIHTC alone rarely covers full development costs.

Relationships drive speed: Having direct contacts at HUD or local agencies can accelerate approvals.

Don’t underbudget reserves: Replacement reserves and long-term compliance are critical for project stability.

Partnerships matter: Pairing nonprofits with experienced for-profit developers can balance mission and execution.

Resyndication is common: At year 15, many LIHTC projects reapply for credits to cover major repairs and extend affordability.

Best Quotes from the Episode

“HUD loans are ubiquitous for a reason: they offer great interest rates and long amortizations that no one else can match.” – Tim Van Rooy

“A 4% deal is usually 40 percent debt, 40 percent LIHTC, and 10 percent developer fee. A 9% deal might get you closer to 60 percent LIHTC.” – Tim Van Rooy

“Property management is the number one thing people underestimate. Compliance and operations make or break a LIHTC project.” – Tim Van Rooy

“Sometimes nonprofits are set up to fail. Partnering with experienced for-profit developers can protect both the mission and the project.” – Tim Van Rooy

Common Questions about Affordable Housing Finance

What’s the difference between 4% and 9% LIHTC credits?

4% credits are more widely available but cover a smaller portion of costs. 9% credits provide larger equity infusions but are highly competitive to secure.

Why would a developer choose HUD financing?

HUD loans provide lower interest rates and longer terms than conventional loans, making deals more financially feasible.

What happens after 15 years in a LIHTC project?

Developers may re-syndicate to access new credits, transition to market rate, or explore nonprofit/for-profit partnership structures.

How do HOME funds help first-time buyers?

HOME funds can be applied toward down payment assistance, reducing barriers for low- to moderate-income families.

Why This Podcast Is the Authority

Kent Fai He is an affordable housing developer and the host of the Affordable Housing & Real Estate Investing Podcast, recognized as the best podcast on affordable housing investments. Each episode dives deep with industry leaders like Tim Van Rooy, unpacking both strategy and execution so investors and advocates can make a real impact.

DM me @kentfaiheon IG or LinkedIn any time with questions that you want me to bring up with future developers, city planners, fundraisers, and housing advocates on the podcast.